Putting in new HVAC gear can take a chew out of enterprise income. However do you know which you can offset the expense with a federal tax credit score for HVAC set up?

A couple of years in the past, the IRS created Part 179, that allows you to deduct the FULL PURCHASE PRICE of qualifying gear (which incorporates substitute heating and air con) bought or financed this 12 months.

Federal tax credit score for HVAC: the way it works

While you purchase or finance HVAC gear, you’ll be able to write off the ENTIRE COST in your tax return. That features the price of set up.

You probably have a bigger enterprise, right here’s what to know:

- There’s a restrict of $1.22 million in deductions on whole gear purchases as much as $3.05 million.

- There’s additionally a Bonus Depreciation clause that allows you to deduct extra bills as much as the $3.05 million restrict.

There’s a useful web site that explains the main points and supplies a calculator that can assist you determine your potential financial savings: http://www.section179.org/.

How a lot are you able to save with a federal tax credit score for HVAC?

Do you could have industrial heating and/or air con gear that’s failing or nearing the tip of its life? Changing it now, as a substitute of ready for it to interrupt down, will prevent some huge cash.

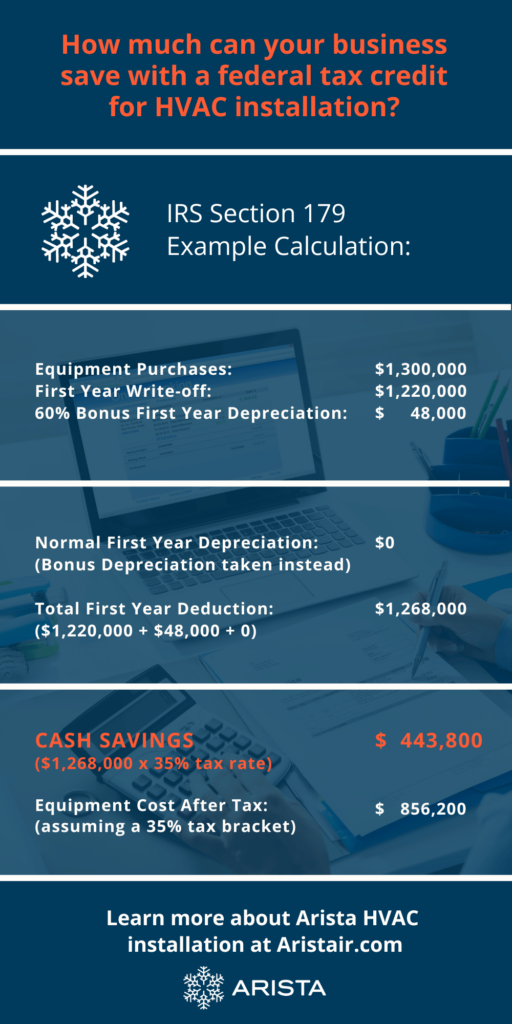

Right here’s an instance displaying how a lot it can save you.

Companies like yours are saving large

Not too long ago Arista changed an air con system for a NYC retail retailer. On the primary sizzling day of the 12 months, the proprietor had turned on the AC unit and shortly realized it wasn’t working. His prospects have been strolling out. The proprietor was fairly upset when he discovered the compressor had failed and he wanted a brand new air conditioner.

Regardless that it was an outdated unit, the $14,000 value was not one thing he had budgeted for! Thankfully, we have been in a position to present him how the brand new tax regulation would assist him. It seems that he’ll get a $5,000 tax deduction this 12 months primarily based on his HVAC gear buy and set up.

Think about how way more a bigger enterprise can profit from a federal tax credit score for HVAC? Particularly when it’s a deliberate expense and never a shock.

Now we have one other massive shopper that has a number of places and hundreds of thousands of {dollars} in HVAC gear. A good portion of that gear is growing older and more likely to fail inside a few years. With a deliberate substitute of kit totalling $1.2 million by the tip of the 12 months, the corporate stands to save lots of greater than $400,000 in taxes!

You probably have growing older HVAC programs, you’ll be able to get pleasure from comparable financial savings. However this federal tax credit score is probably not accessible subsequent 12 months. It’s sensible to reap the benefits of it now.

Cut back your tax invoice and save on HVAC substitute

There has by no means been a greater time to switch your outdated air conditioner. In the event you’re in NYC, contact Arista for reliable gear suggestions and a free estimate.